Personal Finance for Engineers by Nicola Ballotta

Personal Finance for Engineers 🏦 - by Nicola Ballotta #

Excerpt #

A practical, no non-sense guide to handle your finances

When I started working in the IT field at the age of 18 and they told me about my first salary, I couldn’t believe it. I was making more than most of the adults I knew at that time, and with basically no previous work experience.

Having so much money at your disposal at that age usually means just one thing: spending more than what you get.

And this is exactly what I did for years.

Then, when I started to mature a bit in my twenties, I became more cautious. But still, I was never able to save money, and believe me, I could have saved a lot.

It wasn’t until my 30s, especially after having kids, that I understood that despite all my curiosity and passions, I had never studied one crucial topic: personal finance.

Today, I can say I’m educated in personal finance, and I’ve even managed to build some good savings. But I regret not doing that when I was in my early twenties, and that’s why I decided to write this article.

I want to save you from making the same financial mistakes I did and help you start on the path to financial literacy much earlier than I did.

🚨 Disclaimer — what you’ll read here is not financial advice, and you won’t learn personal finance just by reading this. But I hope it will inspire you to dig deeper into some concepts I’ll introduce here.

Here’s what we’ll cover:

🤔 Why personal finance is crucial for Engineers — high earning potential, career volatility, long-term impact

🏁 Getting started — know your numbers, set your financial goals, understand your risk tolerance

💼 The Engineer’s money management toolkit — creating an emergency fund, saving accounts, bonds, ETFs, fun-money, etc.

📊 My asset allocation — a real example of how I allocated my assets and the thinking process behind that

📚 Resources — some good resources that will help you with personal finance

Ready to upgrade your financial knowledge?

Let’s dive in!

🤔 Why personal finance is crucial for engineers #

As engineers, we often focus on coding and solving technical problems, neglecting an equally important aspect of our lives: managing our finances.

However, mastering personal finance is not only crucial for engineers but can also be incredibly rewarding.

Let’s see why.

1) High earning potential 💵 #

Let’s be honest: engineers often make good money, especially compared to many other jobs. This financial advantage comes with its own set of pros and cons.

On the positive side, we have the opportunity to save substantial amounts over time, potentially even retiring early. However, the downside is that without proper money management, it’s easy to fall into the trap of spending more simply because we earn more.

I learned this the hard way by spending all my early paychecks, a common mistake many of us make.

Just because we can afford to buy something doesn’t mean we should.

2) Career ups and downs 🎢 #

The tech world has its ups and downs. One year might be great, the next might bring layoffs or company changes:

Job market changes — while engineers are usually in demand, this can change based on the role, the economy and industry trends.

Startup risks — many engineers work for startups, which can be risky. They might offer lower salaries and stock options that could end up worthless.

Higher competition — as more people enter the tech field, competition for top positions can increase, making it crucial to continuously update skills and stay ahead.

Having good finances can help you handle these changes and choose jobs based on what you like, not just what pays the bills.

3) Long-term effects 🔮 #

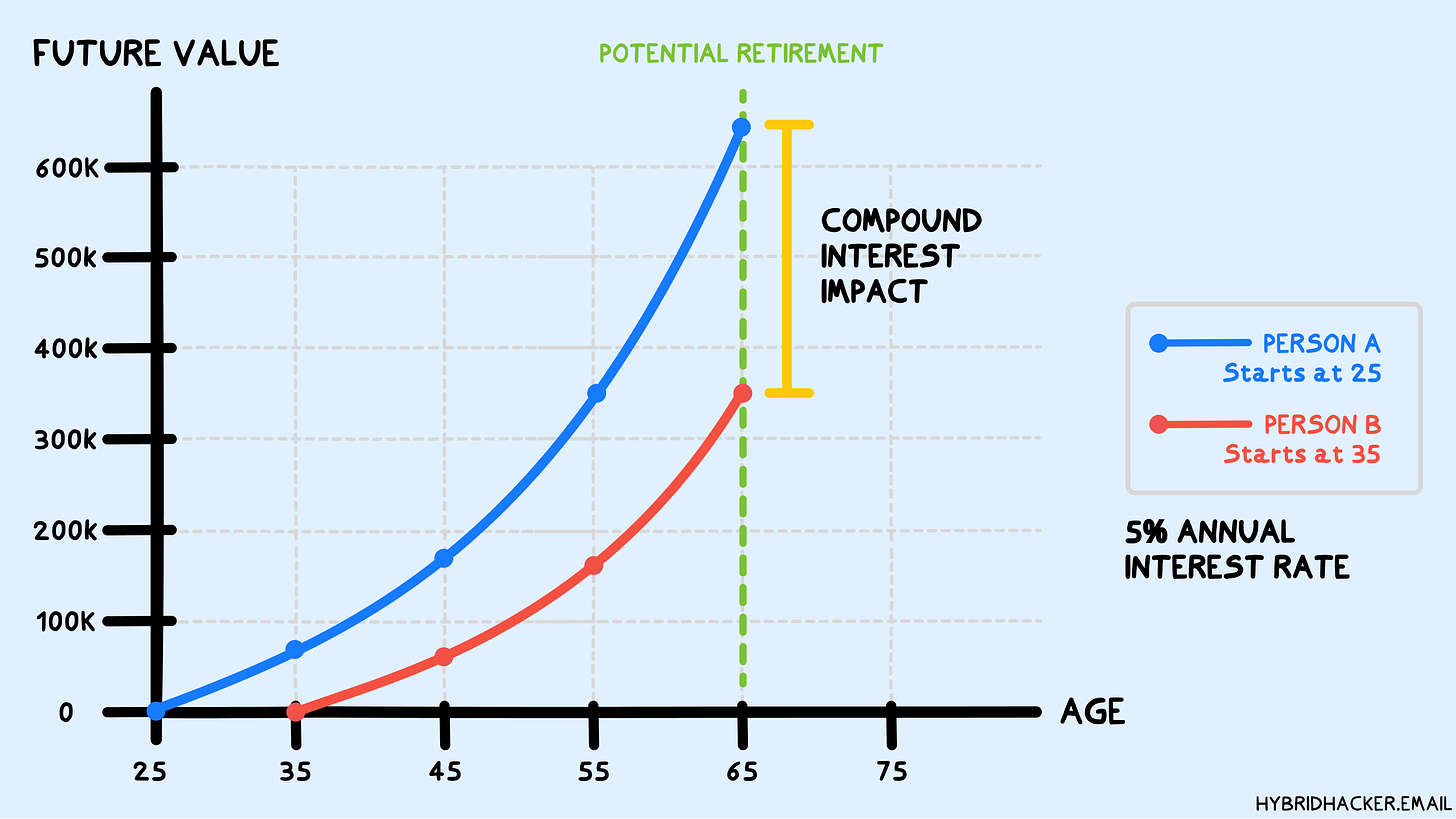

Here’s something I wish I knew earlier: the power of compound interest. As engineers, we are usually good with numbers, but we often don’t realize how much our early money choices matter.

Compound interest is incredibly powerful.

If you start saving even a little bit early in your career, it can grow substantially over time. On the flip side, it’s important to understand that every dollar you spend now is a dollar (plus growth) you won’t have later.

While it’s essential to enjoy your money, being aware of this trade-off can help you make better financial decisions.

[

Quick example:

If you save $5000 a year starting at 25, with 5% annual returns, you’d have about $635k by 65.

Start at 35, and you’d only have about $348k. That’s why starting early matters!

4) Unique financial challenges 🎭 #

As engineers, we often deal with some money stuff that other jobs don’t:

Stock options — these can be a big part of our pay, but they can be tricky with taxes and risks.

Fast-growing salaries — our pay often goes up quickly early on, so we need to keep adjusting how we handle money.

Changing jobs often — moving between jobs can affect things like retirement savings and health insurance.

Knowing how to handle these situations can really help your finances in the long run.

Remember, being good at engineering doesn’t automatically make you good at money. But here’s the good news: as engineers, we have the skills to get good at personal finance once we try.

🏁 Getting started with personal finance #

Okay, so you’re convinced that personal finance is important. But where do you start? Before even touching your money, it’s crucial to establish some systematic approaches and, as engineers, we are lucky enough to have them in our DNA!

1) Know your numbers 🧮 #

First things first: you need to understand where your money is going. It’s like debugging your finances.

Track your spending — write down everything you spend for a month. You might be surprised at where your money goes.

Calculate your savings rate — this is how much of your income you’re saving. A good target is 20%, but start wherever you can.

When I first did this, I was shocked at how much I spent on takeout. Knowing your numbers helps you make better choices.

2) Set clear financial goals 🎯 #

Just like in coding, you need to know what you’re working towards. What do you want to achieve with your money?

Short-term goals — maybe you want to buy a new laptop or take a vacation.

Long-term goals — this could be buying a house, retiring early, or starting your own company.

Write these goals down. They’ll help you stay motivated when you’re tempted to overspend.

3) Understand your risk tolerance 📊 #

In tech, we often talk about risk in terms of project failure. With money, it’s about how much market ups and downs you can handle without panicking.

Low risk tolerance — you prefer safer investments, even if they grow more slowly.

High risk tolerance — you’re okay with more risk for the chance of higher returns.

Your risk tolerance affects how you should invest your money. Be honest with yourself about this.

You might also think to take this test to understand your risk tolerance.

4) Start small, but start now 🚀 #

You don’t need to have everything figured out to begin with. Just like with coding, it’s better to start small and iterate.

Begin saving — even if it’s just a little bit each month.

Learn as you go — read books, follow finance blogs, or take an online course.

Remember, the most important step is the first one. You’ll learn and adjust as you go along.

5) Automate what you can 🤖 #

As engineers, we love automation. Use it for your finances too!

Automatic savings — Set up your bank account to move money to savings automatically each month.

Bill payments — Set up auto-pay for regular bills to avoid late fees.

Automation helps you stick to your plan without having to think about it all the time.

Getting started with personal finance isn’t always easy, but it’s worth it. These steps will help you build a strong foundation. In the next section, we’ll look at specific tools you can use to manage your money better.

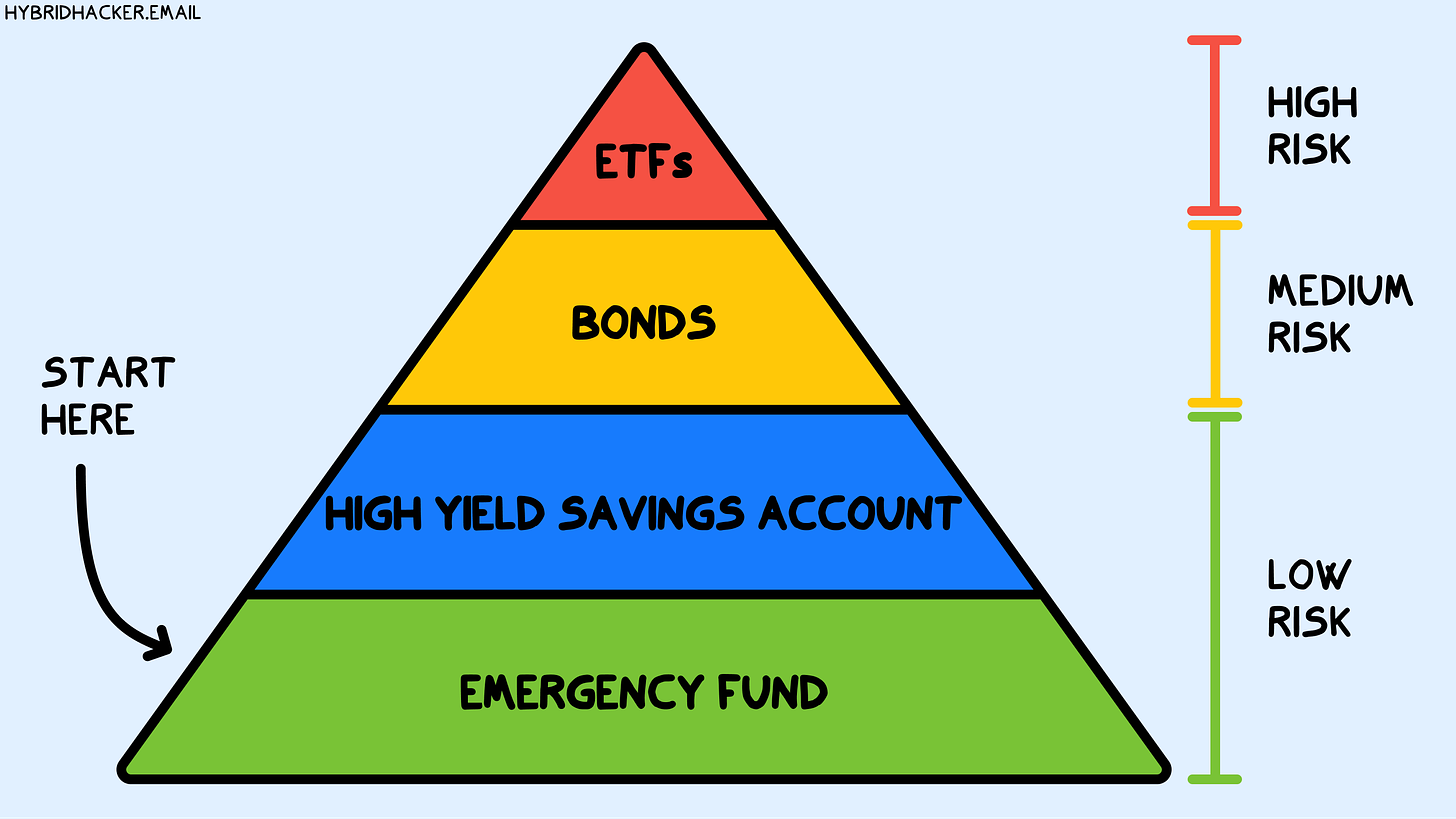

💼 The Engineer’s money management toolkit #

Once you have control over your finances, you know what you spend, how much you can save, and you also understand your risk tolerance.

[

1) Emergency Fund ⛑️ #

RISK LEVEL: 🟢⚪️⚪️⚪️⚪️

Description: Your financial safety net for unexpected expenses or job loss.

What you use it for: Covering sudden costs like medical bills, car repairs, or living expenses if you lose your job.

How much to allocate: 3-6 months of living expenses.

Tips:

Keep it in a separate, easily accessible savings account.

Replenish it after use.

Don’t touch it for non-emergencies.

2) High-Yield Savings Accounts 🏦 #

RISK LEVEL: 🟢🟢⚪️⚪️⚪️

Description: Savings accounts offering higher interest rates than traditional banks.

What you use it for: Storing your emergency fund and short-term savings goals.

How much to allocate: Your emergency fund plus any short-term savings goals.

Tips:

Look for online banks, they often offer better rates.

Check if there are minimum balance requirements.

Ensure the account is FDIC insured.

3) Retirement Accounts 🏖️ #

RISK LEVEL: 🟢🟢⚪️⚪️⚪️

Description: Tax-advantaged accounts designed for long-term retirement savings.

What you use it for: Saving for retirement with tax benefits.

How much to allocate: Aim to max out these accounts if possible.

Tips:

Use your company’s 401(k), especially if they offer matching.

Consider both traditional and Roth IRA options.

Start early to benefit from compound interest.

4) Bonds 📜 #

RISK LEVEL: 🟡🟡🟡⚪️⚪️

Description: Loans you make to governments or companies that pay interest over time.

What you use it for: Adding stability to your portfolio, especially as you get older or approach financial goals.

How much to allocate: Increase allocation as you get closer to retirement or major financial goals.

Tips:

Government bonds are safer but offer lower returns.

Corporate bonds are riskier but offer higher returns.

Consider bond ETFs for easier diversification.

5) ETFs 🌐 #

RISK LEVEL: 🟠🟠🟠🟠⚪️

Description: Funds that track a collection of stocks or bonds and trade like a stock.

What you use it for: Diversifying your investment portfolio across many companies or sectors.

How much to allocate: Can be a significant part of your long-term investment strategy.

Tips:

Look for low-fee ETFs.

Consider a mix of stock and bond ETFs.

Research the underlying assets the ETF tracks.

6) Stock Picking 📊 #

RISK LEVEL: 🔴🔴🔴🔴🔴

Description: Choosing individual stocks as investments.

What you use it for: Potentially achieving higher returns than market averages.

How much to allocate: Only what you can afford to lose; typically a small portion of your portfolio.

Tips:

Do thorough research before investing.

Don’t put all your eggs in one basket.

Be prepared for high volatility.

If you own stocks of the company you work at, don’t forget about them.

7) Fun Money 🎉 #

RISK LEVEL: 🔴🔴🔴🔴🔴

Short description: Money allocated for very high-risk investments or personal enjoyment.

What you use it for: Exploring high-risk investments like crypto or simply enjoying life.

How much to allocate: A small percentage of your income that you’re comfortable potentially losing.

Tips:

Only use money you can afford to lose.

Set strict limits and stick to them.

Remember, this is as much about enjoyment as potential returns.

📊 My assets allocation #

As I mentioned earlier, how you build your portfolio really depends on your unique circumstances: your financial situation, risk tolerance, and personal goals.

But I want to give you a concrete example of how I allocated my assets and a bit of the thinking process I put behind it.

This is how is currently structured:

⛑️ Emergency fund — 12 months of living expenses (with a family, I prefer to err on the side of caution)

🏦 High-yield savings account — 30% of my assets, currently earning a 4% interest rate

🏖️ Retirement account — currently, I don’t have one due to limited tax advantages in Italy

📜 Bonds — 20% of my portfolio, offering returns comparable to high-yield savings accounts at present

🌐 ETFs — 40% of my investments, diversified across various ETFs

📊 Individual stocks — 5% of my portfolio, primarily in tech stocks like NVDA and AMZN

🎉 Fun money — 5% allocated for high-risk investments like crypto and options trading

The first thing I built was my emergency fund. While it’s usually suggested to allocate money for 3-6 months of expenses, considering my personal situation (43, with two kids and living in an expensive area), I opted to accumulate liquidity for 12 months. This is deposited in a high-yield account, separate from my main one, currently giving me 4% yearly interest.

I keep 30% of my liquidity in a high-yield savings account where I can withdraw freely.

As I’m currently living in Italy, I decided not to have a retirement account. While you can save some taxes, the benefits are limited, and your money is locked up for a long time. This could vary based on your home country, so it’s crucial to inform yourself about local retirement savings options.

Another 20% of my assets is in government bonds. I use these for planned expenses that I anticipate in the next 2 to 5 years (which is how I decided their expiry dates).

My risk tolerance is high enough that I’m prepared to see 50% of my assets potentially lose 40% of their value in a few days or months. That’s why I decided to put them in ETFs, stocks, and also have some “fun money” for higher-risk activities like trading and cryptos. For ETFs in particular, I’ve automated the process, allocating a portion of my income every month to selected ETFs, which I rebalance periodically.

Remember, this allocation reflects my personal risk tolerance and financial goals. Your ideal portfolio might look different based on your age, career stage, and financial objectives. The key is to find a balance that allows you to sleep well at night while still working towards your financial goals.

As you gain more experience and your circumstances change, don’t be afraid to adjust your portfolio. Regular review and rebalancing are crucial parts of maintaining a healthy financial strategy.

📚 Resources #

The world of personal finance is vast and different for every person, but I still wanted to include a few resources that could be useful if you are taking your first steps.

1) Brokers #

Interactive Broker (US, EU - what I use for most of my investments)

Tastytrade (US, EU)

Robinhood (US)

Etoro (US, EU)

Degiro (EU)

Trading212 (EU)

Scalable.Capital (EU, limited to a few countries)

2) Apps/Websites #

JustETF — One of the best ETFs screeners

Wallet — The app I use to automatically track my expenses

ProjectionLab — A great service to build your financial plans

Copilot Money — Great app to track and plan your personal finances

3) Learning Resources #

And that’s it for today! See you next week 👋

Sincerely,

Nicola